What are futures?

Futures are contracts where the buyer agrees to purchase an asset, like commodities, currencies, or

indices, at a fixed price on a future date. These contracts are traded on exchange markets, making them

transparent and standardized. The basics of futures trading are about buying or selling these agreements instead

of the actual goods. There are different types of futures contracts, depending on what’s being traded. The futures

market mechanics make sure everything is fair and follows the rules since these contracts are traded in a

regulated market. People use different futures trading strategies to protect against risks or to try and make

money from price changes.

What are Options?

Options are contracts that let you buy (call option) or sell (put option) an asset at a specific

price before or on a certain date. Unlike futures, options give you the choice of whether or not to go through

with the deal, making them more flexible.

Options basics: calls and puts are about understanding the two main types of options—calls for buying

and puts for selling. Traders use various option strategies to make the most of these contracts, whether they want

to manage risk or try to make a profit.

This one of the best futures and options trading courses can clarify all your doubts and smooth the

way of becoming a professional trader in this segment of the stock market.

How do Futures and Options Work?

Before diving into India's one of the best SEBI-registered Equity Research & Analysis Platform,

INVESMATE offers the best F&O trading course, you should first know how this segment of the financial market

works.

Futures Contracts:

-

Buyer and Seller Agreement: The buyer and seller decide on a purchase sometime in the future at

an agreed price.

-

Margin Requirements: Each party will place with his or her broker a margin amount that is

intended to act as a safeguard against losses.

-

Daily Settlement: This contract is daily cash-settled. Accordingly, the results are computed at

the end of every trading session

-

Final Settlement: Depending on the type of contract, on the date specified in the contract, the

transaction takes place at the agreed price or the contract is cash-settled.

Options Contracts:

-

Premium Payment: The buyer remunerates the seller with a premium for the option right.

-

Exercising the Option: The option is exercisable at any point in time prior to the time it

expires if it’s beneficial.

-

Expiration: If the option expires worthless, the buyer runs the risk of losing only the premium

paid.

At INVESMATE , we

offer detailed Futures and Options Trading courses to help you grasp all these mechanisms completely under the

guidance of NISM-certified professionals.

Difference Between a Future and Option Contract

In simple terms, futures and options are both instruments used in the finance stream. Both of these

are contractual-based trading strategies that deal with derivatives, allowing investors to speculate on or hedge

against price movements. So it’s important to know the difference between futures and options through the best

complete F&O Trading course in India that covers everything from basic to advanced under one program.

-

Obligation vs. Right: Futures involve an obligation to perform the basic contract of trading,

while options offer a right without obligation.

-

Risk and Reward: Futures contracts have similar risks and returns, while options have a limited

risk (to the premium for the buyer) and can, for a particular stock, have an unlimited return.

-

Margin Requirements: Traders must make margin deposits when conducting futures, and they must

cover daily losses each day. Option sellers pay the premium upfront, fulfilling their responsibilities

immediately with no further obligations.

-

Flexibility: Options are somewhat more flexible due to the right-without-obligation

characteristic.

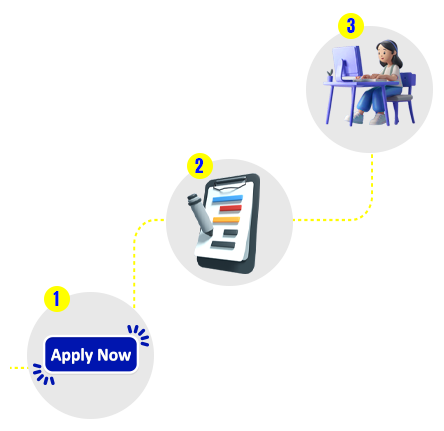

With INVESMATE 's No.

1 Future and Options

Trading course , you can explore these concepts with practical guidance, which will eventually help you

start your successful F&O trading career in the future. You will get to learn every fact about this dynamic

subject. Hands-on learning with a practical approach to the market, which will not only boost your confidence but

also help you implement a proper trading strategy based on your particular financial needs and goals.

Fundamental Analysis for Futures and Options Trading

Fundamental analysis refers to assessing underlying factors that might influence the value of the

assets or an index as a whole, such as economic factors, company balance sheets, market features, etc.

Economic Indicators: Interest rates, an increase in inflation, employment data, and

GDP growth affect the index and stock price of the market.

Company Financials: Whether it is investing, swing trading, or derivatives trading,

it is inevitably essential to study the earnings reports, revenues, profitability, and other relevant statistics

of the company.

Supply and Demand: Supply and demand determine future price changes that relate to

index performances, stock availability, and customers’ interest over a specific time.

Geopolitical Events: Political stability, trade regulations, and other national and

global events affecting markets are capable of influencing people’s perceptions of the market and the prices of

assets.

Technical Analysis for Futures and Options Trading

Technical analysis refers to the analysis of technical indicators, chart patterns, volume, and many

more.

-

Chart Patterns: Futures and options technical analysis differs from the basic technical analysis of stocks in that the price fluctuations and trends are predicted

from the patterns on the charts.

-

Indicators and oscillators: In the futures and options market, technical indicators and

oscillators such as the moving averages, Relative Strength Index (RSI), MACD (moving average convergence

divergence), and stochastic oscillator help the traders determine momentum, overbought and oversold levels,

trend strength, and so on.

-

Volume Analysis: Volume analysis is the key to technical analysis for futures and options, too.

It gives information on the level of market participation and establishes the authenticity of prices.

-

Option Greeks: While dealing with options, technical analysis also consists of comprehending and

using the option chain and various Greeks like Delta, Gamma, Theta, Vega, and Rho. These metrics are helpful

to traders in identifying the effects that may arise from movements in the underlying price, time expiry,

volatility, and rates of interest for the enhancement of option positions.

INVESMATE guides various market modules with a practical approach and hands-on

approach, focusing on such insights and knowledge, and also provides tools and resources to carry out these

fundamental and technical aspects that guide a trader in their derivative trading.